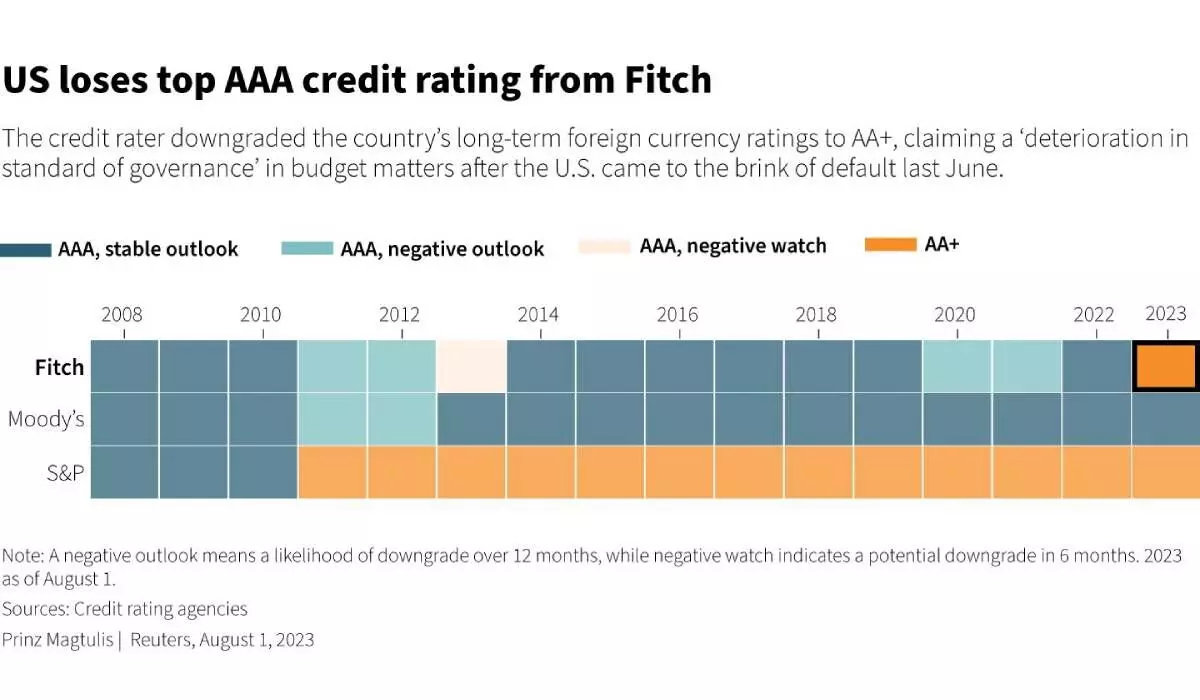

Fitch downgrades long-term ratings of US to 'AA+ despite ‘stable outlook’

India has been pitching for a sovereign rating upgrade with Moody's

image for illustrative purpose

The US administration had a surprise on August 1, courtesy the respectable rating company Fitch, which downgraded the United States’ long-term ratings to 'AA+' from 'AAA' with ‘outlook stable’. This effectively removed the earlier ‘negative outlook’ and the ceiling been affirmed at ' AAA'

Fitch had first flagged the possibility of downgrade in May and maintained the stance in June after the debt ceiling was resolved.

Fitch has attributed three reasons for the revisions. According to them " the rating downgrade reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to 'A and AAA-rated peers over the last two decades that has manifested in repeated debt limit standoffs and last minute resolution.

“There has been steady deterioration in standards of governance over the last 20 years, including in fiscal and debt matters, notwithstanding, the June bipartisan agreement to suspend the debt limit until January 2025.

It may be recalled that there was an uncertainty as to reaching the debt ceiling limit in June. This kept the global market on tenterhooks till President Joe Biden and the Republican-controlled House of Representatives reached a debt ceiling agreement that lifted the government's $ 31.4 trillion borrowing limit.

According to The White House report dated May 3, “History is clear that even getting close to breach of US debt ceiling could cause significant disruptions to financial markets and damage the economic conditions faced by households and business.”

There have been a number of showdowns over the debt ceiling in the past which have sometimes led to government shutdowns.

President Barack Obama had faced similar issues. In the 2011 debt ceiling crisis, US Treasury Debt was stripped of its 'AAA' rating by Standard & Poor's, a rating it held for more than 70 years. Fitch’s has become second major rating agency to strip the United States of its triple ‘A’ rating.

Fitch expects "the general government deficit of US to rise to 6.3% of GDP from 3.7% in 2022, reflecting cyclically weaker federal revenues, new spending initiatives and a higher interest burden"

Another factor is that “lower deficits and high nominal GDP growth reduced the debt to GDP ratio over the last two years from the pandemic high of 122.3% in 2020. It is at 112.9% this year, which is still well above the 2019 pre-pandemic level of 100.1%. This implies that the debt ratio is over two and half times higher than the AAA median of 39.3% of GDP and AA median of 44.7% of GDP.

It may recalled that due to the quantitative easing policy of US and Europe and record spending to boost economy and mitigate the impact of Covid-19, almost all developed countries resorted to fiscal deficit much higher than the normal level, which, in turn, increased the level of government borrowing. Subsequent higher inflation, monetary policy of increasing interest rates and the quantitative tightening, dollar index moving up has resulted in a negative impact

According to latest World Development Report 2022, "This led to an increase in the total debt burden in 2020 for low and middle income countries of nine percentage points of GDP compared with an average of annual increase of 1.9% over the previous decade".

According to policy research Working Paper 9871 of World Bank Group Prospects Group November 2021 "Because of sharp increase in debt during the pandemic induced global recession of 2020, the fourth wave of debt has turned into a tsunami".

Fitch feels that the medium term fiscal challenges are unaddressed. Higher interest rates and raising debt stock will add to the interest burden, while aging population and rising health care costs will add to spending.

Another risk that the agency anticipates is that the US economy may slip into recession and Fitch expects GDP growth slowing to 1.2% this year from 2.1% in 2022 and overall growth of just 0.5% in 2024.

Fitch has also highlighted Fed tightening interest rates by 25 basis points in March, May and July 2023 and it expects one further hike to 5.5-5.75% by September.

On how the US sustained the higher fiscal deficit and higher percentage of central debt to GDP, Fitch says that it includes "it's large, advanced, well-diversified and high income economy, supported by a dynamic business environment."

That the US dollar serves as the international reserve currency of value is to the country’s advantage. Even though there were attempts to diversify the reserve currency by alternative arrangements like Euro and Yen, the share of "US dollars as the world's preeminent reserve currency gives the US administration extraordinary financing flexibility." The administration has to show its responsibility as reserve currency by exercising control on its borrowings as otherwise the share of US dollars in reserve currency will keep sliding. The share of US dollar in global forex reserves has declined from 71% in 1999 to 59% in 2023.

There may not be any major impact on rating downgrade by Fitch. However it will lead to certain discomfort as "the standing and reputation" said Schulman as per a Reuters report.

We may recall that India had resisted the temptation to give away benefits in the form of cash transfer during Covid-19 thereby limiting such spending to a few percentage points of fiscal deficit. But it took the opportunity to announce short and medium-term reforms under Atmanirbhar Bharat Abhiyan for sustained revival of the economy. However India’s National debt to GDP from 75.04% in 2019 reached a high of 88.53% in 2020 and remained at elevated level thereafter at 84.68% in 2021, 83.13% in 2022 and estimated level of 83.25% in 2023. Similarly the fiscal deficit of India went up to record levels of 9.5% of GDP in 2020-21, which has been subsequently brought down to 6.7% in 2021-22, 6.4% for 2022-23 and now has been estimated for 2023-24 at 5.8%. The Centre, as per Fiscal Responsibility and Budget Management (FRBM) Act, aims to steadily reduce fiscal deficit to 4.5% of GDP by 2025-26.

Fitch had on May 8 affirmed India at 'BBB-' outlook stable. S&P Ratings has also rated Indian 'BBB-'Stable outlook. Moody's investors’ service has a 'Baa3' sovereign rating on India with a stable outlook. Baa3' is the lowest investment grade rating. India has been pitching for a sovereign rating upgrade with Moody's. It is necessary for the rating agencies to look at the strength and resilience of the Indian economy in order to enhance its ratings.

The fiscal prudence in times of uncertainty and majority of spending towards Capex having multiplier impact helped India to recover steeply from a negative growth during 2020-21 to 9.1% GDP growth in 2021-22 and 7.1% in 2022-23. The current efforts to bring down the fiscal deficit to 4.5% of GDP by 2025-26 could be advanced by exercising care on revenue expenses and focussing on widening the tax base with enhanced direct and indirect taxes, could go a long way in bettering the prospects for Indian economy. This will help India to achieve the developed nation status by 2047.

(The author is former Chairman & Managing Director of Indian Overseas Bank)